529 Contribution Limits California 2025. In 2025, the annual 529 plan contribution limit rises to $18,000 per contributor. Thanks to the secure 2.0 act, 529 education plan beneficiaries can now enjoy tax advantages after they graduate from college.

Rollovers are subject to the. Accepts contributions until all account balances for the same beneficiary reach.

As with other 529 plans, the california 529 plan allows individuals to contribute up to a certain amount per year per account without triggering any federal gift taxes or using any.

529 Plan Contribution Limits For 2025 And 2025, Most states do set 529 max contribution limits somewhere between $235,000 and $529,000. Individuals may contribute as much as $75,000 to a 529 plan in 2025.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

529 Plan Contribution Limits in 2025, If the contribution is below a certain limit each year, you won’t have to notify the irs of it. Annual contribution limits there is no annual limit on contributions to.

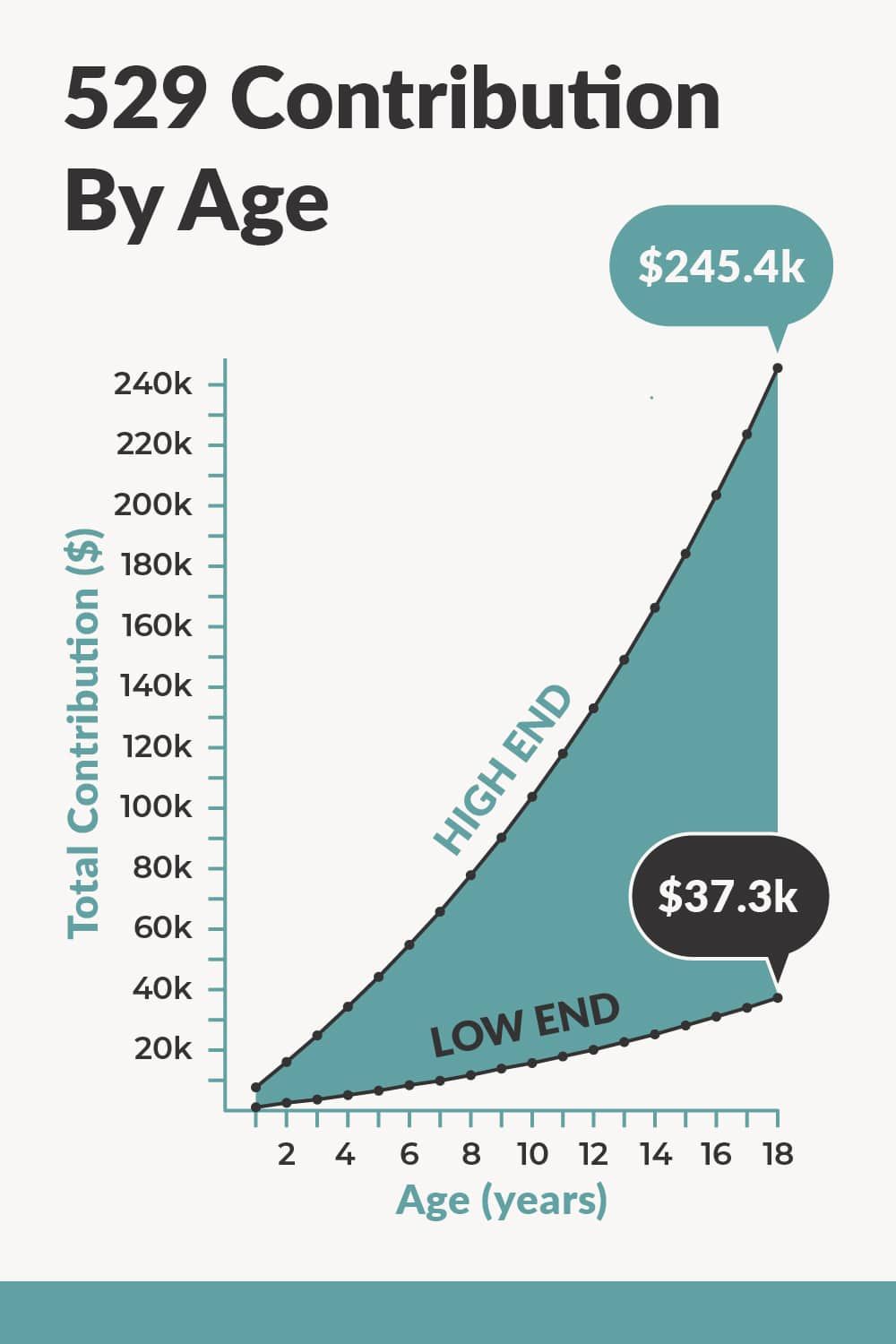

529 Plan Maximum Contribution Limits By State Forbes Advisor, Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary. What is a 529 savings plan?

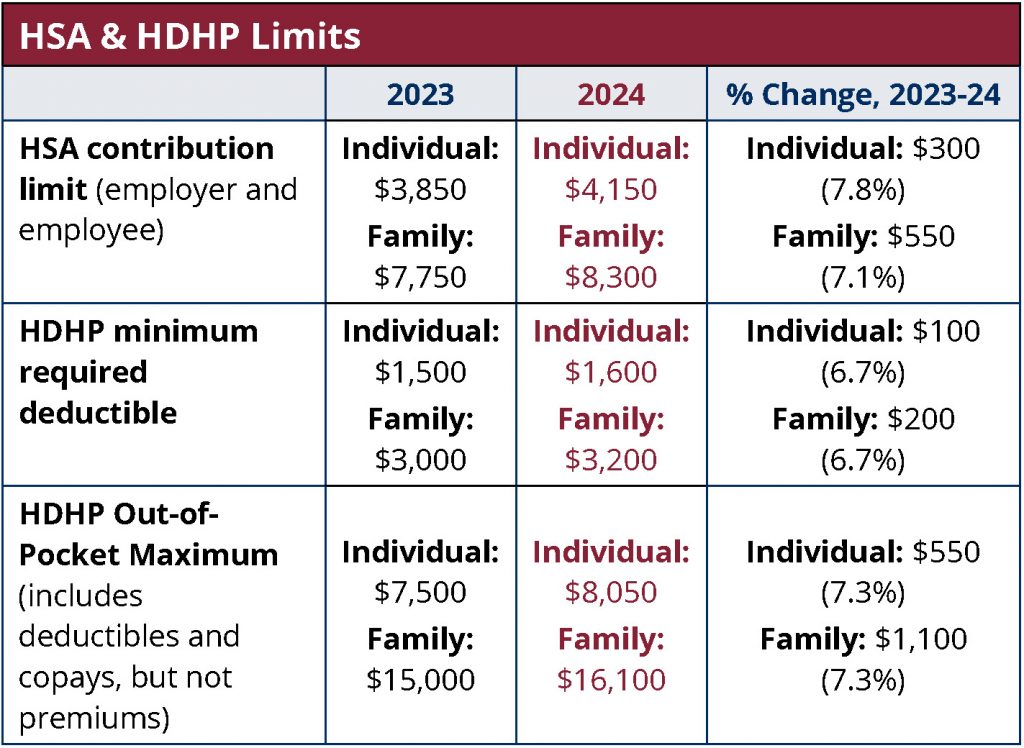

Significant HSA Contribution Limit Increase for 2025, California has one of the highest limits in the country for how much money you can save in a 529 plan. The secure 2.0 act, approved in.

529 Plan Contribution Limits Rise In 2025 YouTube, As of 2025, up to $18,000 per donor per beneficiary ($17,000 in 2025). Do 529 plans have annual contribution limits?

529 Contribution Limits 2025 All you need to know about Max 529, Fittingly, you can contribute up to $529,000 in total to california's. California does not offer any tax deductions for contributing to a 529 plan.

What Should you have in a 529 plan based on your age?, Each state’s 529 plan vendor sets its own aggregate contribution limit. “starting in 2025, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira without a tax penalty,” says lawrence sprung, author of financial planning made.

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, Annual contribution limits there is no annual limit on contributions to. Although contributions are not deductible on your federal tax return, any.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, New year, new rules for 529 accounts. Each state’s 529 plan vendor sets its own aggregate contribution limit.

529 Plan Contribution Limit 2025 Millennial Investor, Accepts contributions until all account balances for the same beneficiary reach. Individuals may contribute as much as $75,000 to a 529 plan in 2025.

Maximum aggregate plan contribution limits range from $235,000 to $529,000 (depending on the state), but such limits generally do not apply across states.